1. Separate Your Emotions - I know this is hard - buying your first home is an all around emotional event. Keep your cool, stay level headed, ask questions and research! Don't buy it just because you love the pool or the color of the kitchen....Remind yourself that this is the biggest financial decision you have had to make in your life....Its an investment - so be sure you are getting the most for your $ and will get a good return on investment when/if you decided to sell in the future.

2. Get a good realtor. Period. Having a good realtor will be your best resource in everything you do related to your new home and future homes. A good realtor will know the market, programs available for first time homebuyers and anything else about your potentially new neighborhood that you need to know. Another thing to know is that you do not have to go through the listing agent to see or buy a house. Just about any realtor can show you any home....Find a good realtor and let them make this a great experience.

3. Skipping your home inspection. Again, this is a huge financial investment, you wouldn't want to buy and be locked into a loan for a house you thought was perfect but not until you moved in did you realize the walls were filled with termites and the electrical was from the 1800's. lol Seriously, this will help you determine if its the best investment for you and it allows you to know what is wrong or needs attention. Do.Not.Skip.Inspection.

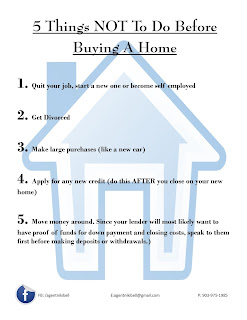

4. Money. Yup, money. You need to know how much you can afford, first off, but you need to also ask yourself: does your loan payment include taxes & insurance? How much down do I need. Is my rate fixed or adjustable....Ask these questions, research. Be confident you can afford your new home. Also, don't go spending money either, like new cars or big ticket items....Wait until after you close on your home if you need to make a big purchase.

5. Rushing. Take your time. Have questions? Get answers. Research. Research. Research...then research some more. It is so important to not rush into the first house you fall in love with...Make a list of what you want in your first home like size, community, schools, shopping, taxes...so many things...Don't rush into this...Its like a marriage, long term...you have to be happy with this decision and it be the best for your and your family.

Hope you find those tips helpful. Please subscribe for future posts!